Wednesday: Tithing on the Gross or Net Income

We calculate our tithe on our “income” if we are paid by the hour or by a salary, and we pay on our “increase” or profit if we are self-employed and have our own business. In many countries, the government takes out taxes from the worker’s pay to cover the cost of services done for the people, such as security, roads and bridges, unemployment benefits, etc. The question of gross or net primarily involves whether we return tithe on our income before or after such taxes are taken out. Those who are self-employed can legitimately deduct the cost of doing business in order to determine their actual profit before their personal taxes are deducted.

Studies of membership’s giving habits reveal that the majority of Seventh-day Adventist tithe on the gross income, that is, before taxes are taken out. In fact, according to the Tithing Principles and Guidelines, published by the General Conference in 1990, “Tithe should be computed on the gross amount of a wage or salary earner’s income before legally required or other employee authorized deductions. This includes federal and state income taxes which provide for services and other benefits of responsible citizenship. Contributions to Social Security may be subtracted-See Guideline 111-F.” — Page 22.

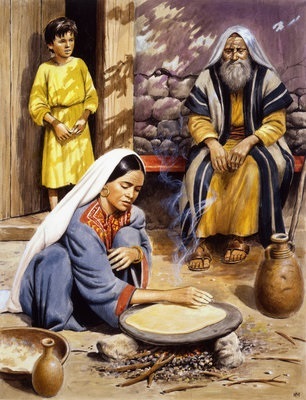

Read 1 Kings 17:9-16. What was the widow’s situation before Elijah came to her? What did the prophet ask her to do first before taking care of herself and her son? What can we learn from this account about the question at hand?

The widow of Zarephath was told by God that a man of God was coming to see her (1 Kings 17:9). When Elijah arrived, she explained her dire circumstances. Elijah first asked for a drink of water and then added, “Do not fear; go and do as you have said, but make me a small cake from it first, and bring it to me; and afterward make some for yourself and your son. For thus says the LORD God of Israel: ‘The bin of flour shall not be used up, nor shall the jar of oil run dry, until the day the LORD sends rain on the earth’ ” (1 Kings 17:13-14, , NKJV).

Was this selfishness on his part, or was he simply testing her faith — in fact, allowing her to exercise her faith? The answer should be obvious.

As we have been told, “Everyone is to be his own assessor and is left to give as he purposes in his heart.” — Ellen G. White, Testimonies for the Church, vol. 4, p. 469.

| How do you explain to someone who has never given tithe the blessings that come from giving it? What are those blessings, and how does returning tithe strengthen your faith? |

(14)

(14)

I have not been commenting the last few days because I was preparing my post on the Hebrew view of tithing. You can find it here https://ssnet.org/blog/tithing-a-hebrew-perspective/

It has been an interesting study and also a challenging one. Does it provide an answer on the question posed by today's topic? The best answer I can give is that "God loves a cheerful giver". Ultimately your tithing is between you and God, but a cheerfully given tithe benefits not only the church, but the giver, and the community.

Thanks Maurice I was looking forward to it.

Awesome.

Good day and thanks, Maurice. The effort is truly appreciated.

Thanks, Maurice. Lots of great information.

Thanks for your contribution mourice ashton

I've been in the church close to 40 years and this is the first time I've heard tithing on the gross. I'm pretty certain I was told "on the net" (and then when you get social security and pension, you tithe on that as your increase). I have always calculated tithe based on my paycheck plus any additional windfalls that happen to come. Hmmmm.

Good point, Al. I note that, while the lesson author (rightly, in my view) recommended tithing one's salary or wages without deducting income taxes, he did suggest subtracting any contributions to a pension scheme (such as US Social Security) from the income to be tithed. Presumably, one would later tithe any benefits received from such a program.

So, it's not "tithing on the gross" in the sense of ignoring business expenses, direct employment expenses, or pension scheme contributions. It's merely letting God have His share (tithes and offerings) effectively before Caesar gets his share (income taxes). Income taxes are not a business or employment expense.

R. G. White, I understand that the US Social Security contribution is not to be included in the gross income but given later when collecting it, but for Medicare, I guess that I should give tithes of while working, right? I would have to find out how much for Medicare is being deducted every paycheck to give the tithes for that, together with the Federal Income and the state Income taxes.?

Hello, Di. I believe that you are technically correct, that only the Social Security contributions might be deducted from the gross to arrive at a "tithable income," not the Medicare part.

On the other hand, it never occurred to me, in all my years of earning wages and salaries in the USA, to tithe in that way. I always just tithed on the gross, deeming Social Security as just another tax. Even now that this distinction has been brought to my attention, I'd probably not bother changing that practice. So what if something gets tithed twice -- once on income paid into Social Security, and again on Social Security benefits?

My sense is that the lesson author was just meeting an objection, and doing so correctly. But personally, I'm not going to be that picky with minimizing my tithe. Through my many years of barely getting by, financially, God never failed to meet my needs. We need not fear that He will let us "starve" if we err on the side of honesty.

Please see if my comment on Friday Lesson Comments Section helps.

Hello, J Al Sargent. I just posted a second comment at the bottom of all the comments and I guess, based on your comment, maybe we could give our tithes both ways: on Gross Income which includes the portion that goes to Federal taxes: for Medicare, Social Security and Government, after every pay check and when retired just deduct the percentage tithed on during the years of work, 6.2% and give tithe on the remaining OR tithe on the net income and when retired give tithe of it all.

I am just learning this, I always thought like you, that tithing on the net income was the right thing to do.

Hello, Di. As one option, you have suggested that we could "tithe on the net income and when retired give tithe of it all."

From your earlier comments, it would appear that by "net income" you mean the full gross wages or salary minus the 6.2% Social Security contribution. You couldn't possibly have meant the net paycheck, from which other items have been deducted which your research has indicated amount to a part of our own living expenses, including the income tax.

I totally concur with the conclusions that you have reached, based on that research, and the clarity that it has brought you concerning what is the tithing baseline, and when any further giving amounts to an offering. The only exception would be your suggested method for tithing Social Security benefits, but that's a minor matter, and harmless in my view.

To my mind, any fears of poverty, arising from prioritizing God's share over "Caesar's," are unworthy of our entertainment. I am far more consonant with legitimate fears of having a heart like the rich, young ruler. Even the disciples thought that Jesus was being unreasonable in His demands, but He knew what He was doing.

R. G. White, thank you for your words; you are right, nothing should separate us from the love of God. In God's method, He adds by subtracting. Thank you.

Although we consider ourselves 'alive' within this world, the foundational basis of 'life' (or rather 'existence') is typically self-seeking. Sometimes the self-seeking is very obvious, but other times so subtle that it can be hard to detect.

In contrast, true life that is the Kingdom of God, operates on a completely different basis - living to give so that others benefit (eg, the widow to Elijah). God gives to us that we may give to others and thus be an integral part of the perpetual 'circuit of beneficence' that is true life (Luke 6:38). And because this 'higher way' of life is radically different, absolutely every aspect of living is also radically different.

What difference does the notion of a 'tithing contract' have when we consider that we are given so that we may participate in giving? Might giving then be more an attitude of life and living than something we are trying to identify the 'technical requirements' of (see Matthew 5:20)?

------

Yes, the bible does contain specified requirements delivered to Israel. But the Bible also reveals a developmental progression where, like training of children, rules are initially introduced and applied until children develop the maturity to learn and willingly apply the broader principles. We see this reflected in Jesus Sermon on the Mount (eg Matthew 5:21:22 to Matthew 5:43-45).

Hello Phil – I appreciate that your comments recognize the importance to establish/maintain true ‘value’ represented in human life. I agree with you that giving and sharing is an intrinsic part when maintaining this ‘value’ of life; if not participated in, life decays. I agree, “we are given so that we may participate in giving – an attitude of life and living ..”!

The capacity of giving and sharing is fundamental to our design and effectually represents the by God sustained life. I believe that the love for our Creator and our fellow man is expressed through the increased desire for giving and sharing freely and generously, as it is guided by the Holy Spirit’s promotion of loving God and our fellow man more and more.

I must say I was spitting tacks by the time I finished reading the second paragraph of today’s lesson. Thankfully, it was countered by Ellen White’s comment at the bottom of the page. Why is the New Testament advice of giving generously, cheerfully and voluntarily not mentioned? It would have been helpful if a page had been added explaining just how our tithe is used/spent in our multi-layered organisation.

Tithing is about love. It is a suggestion from a God Who loves us. He does not have any issues on money or finances, I have. I am human, a creature who often chooses the wrong way, and pays (feels) the consequences of my choices in my "own skin".

Thus, in case I want to know the perfect will of my Creator, I have to search what are His counsels on a given topic, and He's got counsels on every single aspect of life. After all, what I am looking for in this short life is true happiness. The best Instructions to follow are the Manufacturer's.

While I am sold on the returning of tithe on the gross, I have a question about the frequency of giving tithe.

How often did the Israelites give tithe back then; were there specific occasions, or was it that once they had an increase they were to tithe on it?

Hi, Wayne. Perhaps others will have an answer to what the ancient Israelites did. As for my thoughts regarding possible present-day solutions, it seems obvious that salaries or wages would be tithed when received, on the gross amount as you have said.

However, when it comes to business or rental income (I am personally involved in the latter), from which expenses would be deducted on the accrual basis of accounting, it would not be unusual for someone to calculate the net income only quarterly, or even annually.

Personally, I "tithe" (at our usual tithe-and-offering percentage of 10% or more) our rental income every month as we receive the gross rent, using an estimate of the net rent for the month. Then I "settle up" in early February of the next year, once I know what the net rental income actually was for the year.

I suppose that one might alternatively use the cash basis of accounting, if that is more convenient. Everyone subject to income tax will compute a "bottom line" one way or another, at least once a year, or have someone else do it. I hope someone will find these thoughts helpful.

Because the Hebrew tithe was largely associated with food production most tithing was done at harvest time. There are references to threshing floors, oil and wine presses and so on. That was a very practical approach that suited their life style. Fresh produce is much more useful than stale.

I would say give tithe, because we have blessing from God if we do. Now, absolutely, when we give tithe to get blessing, it is not buying a ticket to heaven, it is merely laying up treasures in heaven.

It is interesting to note that God vowed blessings before Jacob vowed tithing. I was also informed that Jacob did not have to pay taxes, unless you count what his father-in-law stole from him. Enough said, except, gross vs net is a personal matter.

I have always known that tithe should be based on the net salary- that the "increase" refers to what actually ends up in your account after the taxes. Whereas this lesson has made me question my practice, I feel like it has left with me with more questions than answers. Apart from talking of studies of membership habits and the quote from the 1990 General conference guideline, there hasn't really been a clear Biblical explanation given as to why the tithe should be on gross and not net salary. Is there anyone who can share insights or links to where I can study more on this topic? Also is there a link to any of the studies that were conducted on membership tithing habits mentioned in this lesson?

When we apply for a job, the salary/wages is advertised as the gross. Our financial dealings are considered on the basis of the gross of our income. Our ‘financial worth’ is based on gross, etc.

Let’s say we tithe from our gross when we should be tithing from the net; would we lose out? Would we suffer financially as a consequence?

What if, instead, we tithe from our net when we should be tithing from the gross? Are not some of God’s blessings according to extent of our giving?

The point l’m trying to make is that you cannot lose when you return from your gross, only gain. Let us search our hearts and consciences before God.

Taxes do not belong to me; therefore I do not pay tithe on what I do not own. The net that remains after the taxes are deducted are what I pay my tithe from.

Hi, Keisha. I am interested in understanding your argument. You are clearly referring to the taxes that are deducted from your pay. Who is being taxed? Why are the taxes coming out of your pay before you receive it? If no taxes were deducted directly from your pay, but you were expected to pay the entire amount from your savings, at the end of the year, then you would have already tithed the money that would end up being used to pay your taxes. Would you find a way to "claw back" that previously paid tithe?

The lesson writer states tithe on business revenue less expense so tithe on profit of the business.

This seems inconsistent with what he said on tithing on the personal level...tithe on gross received 🙄

Why is there a different standard for a business.

One the personal side we all have costs of living too!!

Increase to me is just simply "After all expenses," have been deducted out of the gross. Someone could have a Salaried Job or even an hourly one that takes him or her some traveling expenses that the place of work does not cover so it is a reasonable thing to me for that person to deduct all the wear and tear of their vehicle including the gasoline to drive that vehicle to their place of work and also back home.

Also, I see no mention of the Prophet Elijah or even the account there in 1 Kings 17:9-16, of the widow or Elijah any sort of paying of "Tithe" anywhere.

Are the taxes paid to Ceasar considered an increase?

In the U.K. where I’m from, salaried workers taxes are taken from wages before we receive a paycheck every month. Therefore I never see the gross amount in my possession. Does this make any difference? My actual increase every month is the gross minus government taxes and student loan payment. I want to be faithful and do the right thing, but the subject of tithing on gross/net has me confused. I know we’re to exercise faith and trust in God and I’m praying for clarity. In the end it’s between the individual and God and what is impressed on each one, by Him.

Hi, Ava. Good question. In the end, it is as you say, a matter of individual conscience and accountability. That said, it is good to consult each other for clarity, as you are doing.

My take on this -- and I am an accountant -- is that it does not make any difference what you actually see in your possession. What counts is the nature of the monetary amounts, plus or minus, that go into making up how much you receive. Let me explain.

I'll use the USA as an example, since I am most familiar with their system of taxation. No doubt the UK and Canada (where I live) are in a similar situation.

I'm sure there was a time, upon the introduction of income taxes, when nothing was withheld from a person's pay. One would have filed a form at the end of each year, calculating the amount of tax owed, and then paid up. However, it is unlikely that everyone was very good at saving up money to pay the tax, so the treasury would have had a hard time collecting its due.

The solution, for wages and salaries, was to require each person's employer to withhold an estimate of taxes due, every time the employee was paid. Then, when the "tax return" form was filed at the end of the year, and the actual tax liability was calculated, the government and the taxpayer would settle up with each other, depending on who owed whom.

To illustrate this, let's suppose your salary is $2,000 per month, and you are tithing at 20% (10% tithe; 10% offering). For simplicity, we'll assume that a flat income tax of 15% is the only potential deduction from your pay. Under the old system, you would receive a monthly cheque for the full $2,000. You would then donate $400 of that to the church. Thus, during the year, you would receive a total of $24,000 in pay, and donate a total of $4,800 to the church. Upon filing your taxes, you would then send a lump sum of $3,600 to the government treasury.

Now, the new system of tax withholding is put in place. Three-hundred dollars are withheld from each pay cheque, so you actually receive only $1,700 each month. This totals $20,400 during the year. When you file your taxes at the end of the year, you owe the government nothing. How much should you have donated to the church during the year? Your income and taxes are the same as before. The only difference is the government's method of collection. So, wouldn't you want your contributions to God's work to remain the same? The only way to accomplish this is to tithe the full $2,000 salary each month, notwithstanding you only ever see $1,700 in your possession.

I hope this is helpful.

Thank you very much for your insight on this and the helpful example provided!

How would someone tithe on gross if they lived in a country with a 90% tax rate?

The tax rate should not determine the process

Please, name that country.

The country doesn’t have to exist yet, but that shouldn’t matter, it may happen,

There are several countries where the income tax rate is 60%. Tithing there on gross would mean 25% of your actual pay. Googling will give you the list. Ivory Coast, Finland, Denmark.

Also if you really want to tithe on your gross, then shouldn’t you find out how much your employer pays towards your health insurance and social security and Medicare tax and include that on your gross even though it’s not declared on your pay stub.

From 1944 to 1963 the top marginal income tax rate in the United States was over 90%. In 1944 it was 94%

It would have been impossible to tithe on gross for those people.

Google highest historical tax rates.

Thank you, Robert. Of course, there is a world of difference between a marginal tax rate and an overall tax rate. From what you have said, it appears that no country has ever enacted an overall income tax rate reaching 90%. You say that wouldn't be necessary in order to sustain your argument. I respectfully disagree. As I see it, you would have to cite the actual circumstances of a particular individual. It seems extremely unlikely that anyone has ever been without other income, or savings, and has been forced to live on a pay cheque amounting to only 10% of his or her gross salary. Nor do I believe that this will ever happen.

If we wish to picture an overall tax rate, or a situation, divorced from reality, why not make it 110%, or 500%? If we are going to cite hypothetical cases in order to prove that what I regard as an honest tithe can't be paid, we might as well anticipate the assertion that in such cases -- including the one you mentioned -- if anything, it's the tax that couldn't be paid, not the tithe, seeing God gets His share first.

My wife is no academic or accountant. She is a nurse, and considers herself dyslexic. A detailed explanation goes completely "over her head." Yet even she sees tithing on the gross salary as obvious. In her view, those who tithe on income after taxes are robbing God. I'm sure you mean well, but I mention her opinion as a caution to those who might be tempted to compromise on the basis of the kind of argument that you are making. We judge things, not people, and everyone will answer for himself. But, to anyone reading these comments, please do be careful and conscientious.

A marginal tax rate of 94% can push the overall tax rate above 90% very easily if the majority of your income falls into that upper margin. And I am sure this has happened to people, even if a few, during those years.

And even at a marginal rate would you say that the income in that margin would be impossible to tithe since more than 90% of it was taken by the government If you had an income of 100,000 at 30% tax rate, your check would be 70,000. If you tithed on gross your tithe would be 10,000 and would have 60,000 left, on net your tithe would be 7,000 and you would have 63,000 left. If you made 50,000 more at the 94% marginal rate, then your check would be 73,000. If you tithed on gross the tithe would be 15,000 and you would have 58,000 left. On net you would tithe 7,300 and have 65,700 left. So in this very real scenario, the more money you would make, the less money you would actually have as increase, once you reach an income of 1,600,000. Your check would be 160,000. If you tithed on gross you would have nothing left, if you tithed on net you would have 144,000 left

But even if it only pushed you to an overall tax rate of 80% or more, is it realistic that God would expect half of your actual available income to be returned as tithe.

This concept is very inconsistent.

Let’s say your paycheck after taxes was 50,000. And the government needed money and imposed a new tax on your employer in a way that it was through accounting principles alone and added as a tax to you and they raised your gross income by an additional 100,000, but your paycheck remained the same at 50,000 and you had no control of the situation. It would make no sense that you would be expected to increase your tithe by 10,000 when your actual check, your increase, did not change at all.

I would never condem or suggest that someone that wished to tithe on their gross income not do so, but to promote the idea as being necessary, when it may only work circumstantially is very biblically inconsistent. God changes not, and he would not expect us to change practices depending upon circumstances. And there is no way that tithing on pre tax gross income is not affected by circumstances that the government imposes.

Hi, Robert. You wrote:

A person could probably go back and look at the actual tax brackets for the US in 1944, and use inflation rates to convert the dollar amounts to their current equivalents, but there is little doubt as to what we'd find. Someone must have had an extremely high income in order to get into the 94% tax bracket at all. To get far enough into that tax bracket for one's overall tax liability to reach 90% would have required an astronomical income, quite possibly more than anyone actually made in the USA during that tax year.

Furthermore, people of extremely high income generally do not receive all or most of it in a salary. They are in business for themselves, and they pay the taxes themselves, not through tax withholding from an employer's payroll. They also tend to have substantial assets which they could easily use to cover both tithe and taxes, for as many years as necessary. Since this discussion is about tithing on the gross or net amount of a pay cheque from an employer, the circumstances of the extremely wealthy are not even relevant here. If worse came to worst, which again I don't think has ever happened or ever will, and one actually had to short either God or the government, I think I know how that should go.

Basically, as an accountant, I do not find your scenarios to be very realistic. Maybe it's a bit much for me to ask you to cite actual, individual cases, but you would at least have to use actual, historical tax brackets converted to today's dollars, and base your hypothetical situations on that. If you did, I'm pretty sure that the case you are making would dramatically fail -- that is, if you are saying it could be literally impossible to tithe one's income before taxes.

If you are talking about a mere unwillingness to contribute tithes and offerings beyond a level that you feel God could reasonably expect, then your scenarios might become more realistic for the more extreme cases. But that's a whole different ball game, on which I'd rather not comment.

As you said, it's not about judging or condemning anyone either way. It's about trying to give the readers of this blog good counsel. In harmony with the lesson author, I definitely stand by tithing one's total income, regardless of any taxes. If you ever hear from anyone who finds this literally impossible, I'd love to know about it.

The current withholding system was instituted in 1943 during the war as a way to collect, and give the government the ability to actually institute more oppressive taxes, which came the next year when the 94% top margin was enacted.

Only 11 states require a pay stub that would list the gross income when your check arrives, and the federal government does not require it.

And as pointed out in many other countries in the world the people are not given that breakdown either.

Also most employers pay tens of thousands of dollars in benefits for employees that are not itemized in the gross on stubs either.

How is anyone expected to know the gross income if it is not itemized. It gets way too complicated.

It is easy and consistent to know how much is actually received.

Was there any mention in the Bible when the coin was retrieved from the fishes mouth to pay the tax, of shaving off a tithe from it first?

Gods principals are consistent, easy to understand, and do not change by circumstances.

The principal that does not change by circumstances, is always fair, and easy to understand no matter how oppressive a government is: Return 10% to God of whatever you actually receive, no matter where it comes from.

I fear that the appearance of requiring more than this, and the apparent inconsistencies, may be a large part of why more people don’t return tithe at all, unfortunately.

Tithing on income after taxes could only be construed as robbing God if it is done out of selfishness. And only God knows if he is being robbed. We don’t know what is in the hearts of others.

Strange that nearly all responses have been from folk who earn a living by the sweat of their brow and are taxed in a fairly equitable fashion by the government of the land. BUT - how does one respond to questions about tithing from those who have nothing, and do not even know about gross or net? What is the basis of giving to support the Lord's work in other lands where the labourers are few and the work is voluntary? Where the gospel is spread in secret. Where punishment is dealt to those who support 'foreign aid'.

Please watch Pastor Julian Archer's message to Woollahra SDA church on 19 March 2022 - 'The Heart of Stewardship'. He celebrates God's love and our response to God's gifts to us. It's that simple.

Someone asked a related question on the Hope SS video - "can God still bless those who don't have a job and are unable to tithe?". I hadn't considered the aspect of persecution in relation to tithes. Thank you for bringing this up. Food for thought.

This topic has left me concerned all weekend. I have read all the comments and still was not able to feel at ease. I have had a deep sadness; I have had this anguish that does not go away. I have prayed for God's help and today I did a bit of research on what the taxes are used for.

Payroll taxes are taken from my gross income and are used to pay for: government spending, Social Security and Medicare, the last two through the Federal Insurance Contributions Act (FICA). FICA taxes add up to 15.3% of an employee's gross pay: 7.65% from the employee and 7.65% from the employer. Social Security has a tax rate of 6.2% and Medicare has a tax rate of 1.45%, so yes we need to tithe on the gross salary, because most of it is used for our benefit, future retirement and future medical, and when retired I could subtract the 6.2% (which was my share in the years of work) from the Social Security retirement check (if I paid tithes on my gross income when working), and tithe from the Social Security retirement check on the excess. In other words: when retired, Social Security Retirement pay, less 6.2% is what I will tithe on when retired, providing I have tithed on the gross salary in every pay check during the years of work.

Another reason for tithing on the gross salary is because God should be first, before using our wages to pay for: Federal taxes, rent or mortgage, groceries, college, etc... we must set apart our tithes and offerings, God must be first.

Thank you to all of you, for all the comments, because in the end, together with the online research to get a better understanding, all have helped me to learn and understand that we need to tithe on our gross and not on the net salaries. Not that I don't want to give to God what is due to him, but that I needed to know what exactly God required of me, I needed to know the base so I know when I am giving over and above.

I was very sad; it terrified me to think that my sadness may be like the sadness of Cain when he realized that his offering was not accepted before God or the sadness of the young rich man when he was required to sell all he had and give it to the poor. I didn't want it to be the spoiled sadness or a tantrum from my part to where I become blind.

Hi Di, I just want to tell you not to beat yourself up over what you did. I don't think you should feel you are like Cain. He had the wrong attitude and you acted more out of ignorance which the Bible tells us God "winks at" at certain times, anyway.

I personally feel tithing on gross income is right, especially because once you start deducting things it's easy to get to the point where there is barely any income. But others see things differently and I don't judge their choices. We each answer to God for what we know.

This topic has got me out of my zone comfort, a topic that has caused discomfort, but God's Spirit continues his work in us, I just pray I have eyes to see and ears to hear to obey. Thank you, Christina Waller, for your words.

I have really enjoyed reading the comments. Now my question is, assume that you paid tithe as per your gross net, and after serving the required years you retire.

Now will this person pay again the tithe from the income received from retirement income?

Help me to understand this please?

Others may have further thoughts, but my response would be threefold.

1) The purpose of these lessons is to educate a readership of free moral agents, not to rein people in to behave in lockstep with the will of church leadership. So, if you should find yourself in the situation that you have described, you are free to answer this question in accordance with your own beliefs and conscience.

2) Your specific objection is answered in the lesson for Wednesday, January 18, where the General Conference guidelines are quoted:

These guidelines are obviously specific to the USA, but can easily be adapted to the situation existing in another country. Income taxes are not a business or employment expense. They are a personal expense, just like food and clothing. It just happens that, in some jurisdictions, employers are compelled to withhold these taxes from their payroll before paying their employees, and to submit them to the government.

The income taxes withheld are credited to the employee's account with the government. This means that the employee has constructively received them. It wouldn't be right for me to refuse to tithe this part of my income, just because it doesn't make it into my bank account, but goes directly to the government to my account, pending a settling up of taxes after the end of the year.

Note that the guidelines allow for subtracting Social Security contributions from income that is subject to tithes and systematic offerings. In Canada, for instance, this would apply to Canada Pension Plan deductions. This practice would eliminate the problem of tithing the same income twice, that you have cited.

3) Personally, I find the idea of subtracting contributions to government retirement plans, before tithing my wages or salary -- or refusing to tithe my government pension plan benefits -- ridiculous. I'm not afraid that giving God slightly more than He actually claims will lead to poverty. In financial dealings, it is common for friends to dismiss mutual obligations with the words, "What's that between you and me?" Well, Jesus is absolutely my best friend.

Does any of this help?

It can actually get quite complicated. We pay into a government-required superannuation scheme 9% of our income. Over the years this fund grows and sometimes shrinks depending on economic circumstances. It would be fairly difficult to calculate what is actual increase and what is just keeping up with inflation. It is a lot different from walking out into the cow paddock and counting the number of cows, comparing that with the number of cows, you had last year, and dividing the difference by 10.

My rule of thumb is simply to tithe generously with a thankful heart. You do not need to be a financial mathematician to do that.

Of course you are right, Maurice. It could get as complicated as we care to make it. In the context of this lesson and Lucy's question, I understand the practical application of your "rule of thumb" to be: Tithe (and contribute generous offerings from) your gross salary, and don't sweat the small stuff.

My excuse for giving such a detailed response is the detail-oriented nature of Lucy's question. But, lest the details of my answer get in the way of understanding its conclusions, here is a simple summary.

1) If you choose to tithe only your net pay cheque, you are a free moral agent. But I could never do that without feeling that I was robbing God.

2) If you are particular enough that the possibility of tithing even a small part of your income twice is utterly unacceptable to you, then the correct though imperfect solution (in the US context) is to subtract only your Social Security contributions -- not even the entire FICA deduction, which includes Medicare -- from your gross salary before tithing it. But...

3) To my mind, the best answer is: Tithe (and contribute generous offerings from) your gross salary, and don't sweat the small stuff.

I appreciate Maurice's thought of tithing generously with a thankful heart, along with your reply, Gordon. It looks to me like you are both on the same page.

It did not occur to us to subtract deductions for retirement income (social security, pension) before tithing. And now that we are benefiting from the government pension plans and social security, we are treating that as tithable income as well. I suppose, technically, some of this was tithed twice, but I don't think we can outgive God. We were blessed when we tithed originally, and we are blessed again as we tithe now. So I suppose we can consider ourselves twice blessed!